TARIFFS

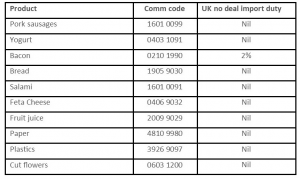

The UK have released their no deal tariffs. We’re still absorbing most of the information (2,000+ pages!) but the key points are that 87% of trade will be free from duty. We have an xl doc with the duty rates shown across 470 tariff lines and understand that if they are not listed, they are nil. There are roughly 5,500 tariff lines so the 87% figure sounds about right. Let’s take some sample commodity codes…

How do they come up with these rates? Basically import duties are applied to protect domestic production/supply. When (if!) we leave the EU we need only apply duty to those things that we make (or produce) ourselves. A perfect example is commodity code: 0406 4090 blue vein cheese (stilton or similar). In the no deal tariff UK have applied duty rate of €18.60/100kgs but have EXCLUDED gorgonzola (we don’t make it, plus it has Geographical Protection).

We attach a cleaned up version of the no deal tariff. Look up your commodity codes and your duty rates will be shown. These apply to EU to UK flows (excluding NI, see below). If you don’t find your commodity code in the list, take it that nil duty applies. Make sure you have the right commodity code.

IMPORT ENTRY IF ZERO VAT AND ZERO DUTY

I have been asked (a few times) if an import declaration is still required even if the duty and VAT are nil. Short answer is yes. The import entry shows what the goods are and what duty and taxes apply. So, until such time as an import entry is submitted the goods are unknown and technically dutiable. Consider it this way: EU trade is innocent until proven guilty. Non EU trade is guilty until proven innocent. Hence the need for import declarations (even if nothing is payable). Do you still need a duty deferment account? Yes. TSP requires a deferment account (HMRC will gift if to you initially, so don’t panic if you don’t have one yet). TSP allows you to import smoothly but you might import dutiable goods, therefore you’ll need a deferment.

TSP PROCESS FLOW – WHO DOES WHAT?

Let’s assume you are an importer and have TSP approval. Here’s what needs to happen (example is a full load trailer):-

1. EU exporter raises an export declaration, known as an EAD (Export Accompanying Document)

2. Acceptance of this declaration by their national Customs computer generates an MRN (Movement Reference Number)

3. Give this MRN number to the driver – he will not be allowed to check in at the export port (say Calais) without it

4. Make sure the driver also has the TSP approved UK EORI number – he will not be allowed to board the ferry without it

5. Arrive in UK. Deliver as normal, we’ll take care of the rest (assuming you have appointed us as your Customs agent)

NB – not only does the EAD export declaration create the MRN but it also auto creates the EXS (Exit Summary Declaration) which alerts the exit border of your imminent arrival.

Make sure your EORI number is on all documents (include it as part of your address). The driver will need it and it would be a great shame if, at 2am in a queue in Calais, he could not find it!

In nearly all cases you will NOT require health certificates or additional documents, assuming goods are of EU origin and supply. Some exceptions exist, such as plants covered by the plant passport scheme. Contact us if you are unsure.

TSP RETURN : WHAT DO WE NEED TO COMPLETE THE TSP RETURN?

In simple terms, a copy of the EAD completed by the exporter and a copy of the commercial invoice (so we can verify the value for duty). Eventually we will make this more scientific but for now we just need the EAD and invoice. Where do you send it? We’ve been clever (perhaps too clever!) and recently bought the domain name www.eori.uk. So, once you’ve raised the EAD and invoice, scan them and send to EAD@EORI.uk. Simple! We will complete the TSP return and send confirmation to you. If there is any duty to pay, Customs will collect that from you directly.

VALUE AT IMPORTATION

It is quite common, in EU trade, for the buyer and seller to be related in some way. Group companies, subsidiaries etc. There are six valuation methods for imports but the most common is method 1, transaction value. So, what is the value for duty? In simple terms it is the CIF UK arrival price, but you need to consider factors that can influence that price. Things such as licence or royalty fees. To give you an idea of how the value is made up, see attached form C105A – this perfectly explains what you need to consider.

DO YOU NEED A BONDED WAREHOUSE IN THE UK?

I am often asked this question. In general terms a bonded warehouse is used to suspend payment of duty until the goods are required. You only pay the duty when the goods leave the warehouse rather than when they arrive in the UK. EU supply chains are historically fast moving and thus duty suspended storage is unlikely to be an issue. A greater issue is when goods come in to the UK and are Customs cleared (TSP or otherwise) with duty being paid (if any). You then decide (or discover) that the goods are to be re-exported to Ireland. You may have ‘wasted’ the payment of duty in the UK (since the goods are not intended to stay in the UK). A bonded warehouse is more expensive than a normal warehouse and therefore there will be a tipping point between the (wasted) payment of duty versus the additional costs required to avoid this happening. It all depends on the duty rate involved. Now that these have been published the situation is clearer. If the duty rate on your product is positive and there is a chance of it being diverted to Ireland after clearance then a bonded warehouse (or similar) may be a good option. Decide if this is likely to be an issue (based on the attached duty tables) and if so speak to us so we can advise on alternatives.

THE UK EXPORT PROCESS

Much effort has gone in to keeping UK imports flowing smoothly. I am sorry to say very little effort has gone in to supporting UK exporters. As of now UK exports will be subject to full 3rd country duty rates on arrival in the EU. UK cheddar cheese for example will attract an EU duty rate of €167.10/100kilos (whereas gorgonzola shipped to the UK will be duty free). Agri foods and other controlled goods will be subject to additional health checks on arrival. Transit documentation will be required in most cases, see below. All of these factors create a much slower export flow particularly when compared to the smooth flowing import traffic. This will undoubtedly lead to delays on UK export port approach roads. Ironically the faster the import flow the larger the queue at export. What can you do about it?Firstly make sure you have the required health certificates or licences to enable export. Consider how you will create the UK EAD (export declaration). You can do this yourself or we can look after this for you. Read our step-by-step guide to exporting which you can find at www.mybrexit.uk/downloads

TRANSIT

We mentioned this on a previous update but the issue is still outstanding and HMRC have not yet devised a suitable solution or easement. To explain transit is not easy, the transit manual is in excess of 750 pages, but here goes…. Assume you ship from Dover to Calais with your ultimate destination being Germany. In order for the goods to move uncleared from Calais to Germany, a transit document is required. The transit document contains a guarantee (backed by a bank) which states that the goods will move from A to B (B being Germany in this case) and will be declared to Customs at B with duty and taxes paid accordingly. If this fails to happen, the guarantee holder automatically becomes liable for those taxes and duties. The financial guarantee required must be capable of supporting all uncleared goods in transit at any one time. A transit can take up to 10 days to register as finalised. It is not unusual for a transit guarantee to be in excess of £1 million! There are currently not enough guarantees to support the UK export flow. Worse still, the transit document needs to be authenticated prior to export. This can be done by an Authorised Consignor or at the port. There are not enough Authorised Consignors currently in place. Authenticating at the port, say Dover, could add one hour to each export vehicle. There are over 5,000 export vehicles per day! We have applied for a transit guarantee but as I write we are still awaiting confirmation of HMRC acceptance. Similarly we have applied for Authorised Consignor status and we are still awaiting this also.

THE IRISH BORDER

HMRC have released their no deal plan for the Northern Ireland land border. No checks, no tariffs, no nothing! Excise duty and cross border VAT would still apply as today but there would be no additional tariffs and no significant checks aside from certain goods in order for UK to comply with international obligations. Trade from NI to Rep of Ireland would still be subject to EU 3rd country duty. It is not clear what arrangements (if any) would apply to trade from NI to GB but clearly this cannot involve a border in the Irish Sea. Therefore one would assume that NI to GB would be unrestricted. This obviously leads to a duty-free back-door in to the UK. Strange suggestion by UK GOV which has clearly not been thought through. A Mercedes imported from Germany would attract circa 15% duty whereas if that were shipped from Germany to Dublin and then Belfast to Liverpool the duty could be nil… no comment!

Since starting this update UK Parliament has voted to remove no deal from the table, meaning the UK will not leave the EU without a deal. Does that mean no deal is impossible? No! The EU have not agreed to this measure and no deal is the default position in the absence of a deal. One cannot unilaterally decide that failure to reach a deal is unacceptable.

At a recent industry day in Lille, which we attended with UK and FR Customs, the killer statement from HMRC was “the biggest risk is that traders are not prepared.” Surveys in this respect vary significantly but I have not seen one that suggests even half of traders are ready for no deal.

Robert Hardy, Commercial Director, Oakland International