LETTER FROM HMRC TO ALL EU ONLY UK TRADERS

HMRC recently issued a further communication to around 145,000 UK traders who may be unfamiliar with Customs processes. Copy of the letter is here : https://bit.ly/2UgH0ys We have received many questions about this letter. Let’s deal with them one-by-one:-

GET AN EORI NUMBER : We covered this in update no.1 but if you haven’t yet applied for your EORI number please do it now. https://bit.ly/2FWv16h You should note that if you intend to be an importer in the UK, then you will need a UK EORI number, you cannot use your non-UK one. You do not need to have a registered company in the UK but you may need to apply for UK VAT registration. Contact us if you need any help as we can normally handle this for you.

GET A CUSTOMS AGENT (OR DO IT YOURSELF) : We often hear “we already have an agent…. (for Felixstowe/London Gateway/Southampton etc)”. Good, but be aware that Dover/Eurotunnel is likely to act differently from the normal. Reason is the sheer volume of accompanied road freight (circa 4.5million trucks per year). If you already have an agent, make sure they know how to clear at Dover/Eurotunnel in a post-Brexit environment, noting that it is likely to be non-inventory linked and require a pre-lodgement BEFORE shipment. It is unlikely that many traders will be ready to perform their own UK Customs formalities by 29th March 2019 particularly when you consider the concurrent issues such as HMRC upgrading to CDS and the changes brought about by the Union Customs Code (UCC) which the UK have said they will continue to adopt. Help is at hand. We are ready to take care of Customs formalities from day one and have invested in staff, training, IT, HMRC and port connections. The choice of import agent is completely up to you but you can relax in the knowledge that our safety net is already in place.

SAFETY & SECURITY DECLARATIONS : Many will be unfamiliar with this process (including many international hauliers!). For goods crossing a border there is a requirement for an EXIT declaration and a corresponding ENTRY declaration. This ‘warns’ the authorities that a border crossing is due to take place. In most cases this needs to be lodged at least 2 hours before the actual crossing (may be reduced to 1 hour for Eurotunnel). In most cases the export declaration automatically creates an EXIT S&S advice. The process is not linked when it comes to imports. Ask your transport provider if they can complete S&S declarations. Again, the safety net is already in place. We can complete these declarations for you (or your haulier) should the need arise.

DO I NEED CUSTOMS SIMPLIFICATIONS?

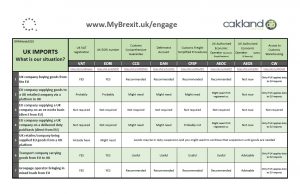

We have mapped out what an export would look like with or without Customs simplifications. We have done the same for imports. Our charts can be found here :https://www.mybrexit.uk/process-flow We recently posted these charts on LinkedIn and they have received more than 50,000 views and multiple likes. Customs simplifications are not essential but the process certainly looks more secure with them. With Customs approvals and simplifications it is possible to avoid some of the pitfalls and allows you to keep goods moving with little or no interference en-route. What simplifications do we mean? For sure, CFSP (Customs Freight Simplified Procedures) with AEOC as a bolt-on. We are often asked if AEO is essential. At the moment it is in the ‘nice-to-have’ column. AEO is NOT required for CFSP or Customs warehousing. It does make it better (cheaper) but with NO DEAL looming, AEO on its own is a little like re-arranging the deck-chairs on the Titanic! Our recommendation is CFSP with AEOC approval following closely behind. We can handle both for you and are already working with around 200 companies (food and non-food) in this regard. What you need will depend on your situation, the attached table may assist and help you decide how to proceed.

FOOD LABELLING

UK Government have issued advice which can be found here : https://www.gov.uk/government/publications/producing-and-labelling-food-if-theres-no-brexit-deal/producing-and-labelling-food-if-theres-no-brexit-deal Amongst the advice is the requirement for UK address on EU food and EU address on UK food labelling. At Oakland we are ideally placed to assist with these labelling requirements having a legal entity in both the UK and the EU (Ireland). Contact us if you require a UK address for the UK market and similarly, should you require an EU address on your UK food exports. We are happy to arrange contact telephone numbers in both UK and EU also. Make sure your labelling is compliant post-Brexit and get in touch if you need help.

UK IMPORT DUTIES (ON EU GOODS)

Lots of speculation here, particularly at the moment. Worst case scenario is that UK apply the current full 3rd country tariff to imports from EU. This is unlikely but not impossible. UK currently looking for ways to avoid this situation whilst respecting WTO MFN rules. There appear to be options but one must remember that this is still a very tight negotiation and UK will want EU to believe that duties will be applied, whilst at the same time trying to find ways that this will not be necessary. Interesting times. Further updates will cover this topic as it develops.

FURTHER INFORMATION AND UPDATES

We try to keep these updates short and sweet (and frequent) so you are not bombarded with information. We would however recommend that you keep up-to-date with our blogs on www.mybrexit.uk and also follow on LinkedIn https://www.linkedin.com/in/robhardyfr8/ In case you didn’t see Brexit update no.1 you can view it [here]. Further updates will cover:-

1. Export paperwork – what is an EAD?

2. Do I need to stock-pile?

3. Delays on exports (or import trucks returning)

4. Brexit policy statements

5. Goods in transit (including to/from Ireland)

With March 29th rapidly approaching, 2019 promises to be one of the most interesting in years. We’ll continue to do our best to prepare you for the worst whilst hoping for the best.

Robert Hardy, Commercial Director, Oakland International